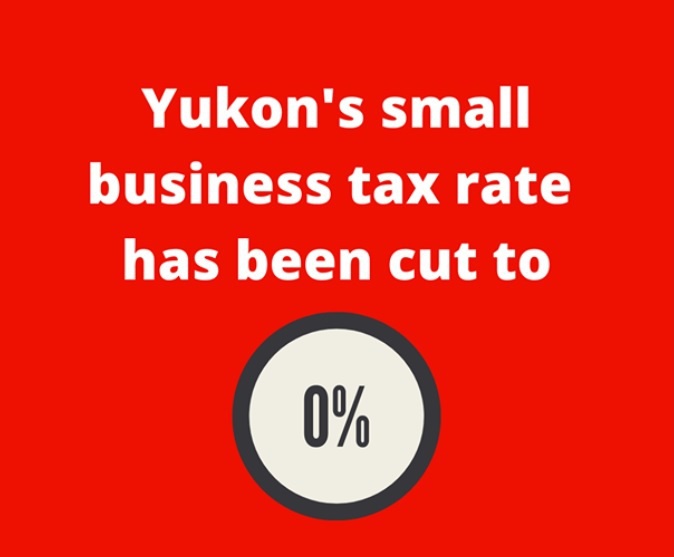

This change will support Yukon businesses and is expected to save this sector approximately $2 million per year. Yukon joins Manitoba as one of two Canadian jurisdictions to permanently reduce this tax rate to zero.

Yukon’s small business tax rate has been reduced from two per cent to zero. This change took effect on January 1, 2021 as one of the measures introduced as part of the Budget Measures Implementation Act, 2020. This change will support Yukon businesses and is expected to save this sector approximately $2 million per year. Yukon joins Manitoba as one of two Canadian jurisdictions to permanently reduce this tax rate to zero. The government anticipates approximately 2,000 small businesses will benefit from the rate reduction.

"Last spring, we made a commitment to support Yukon businesses by cutting the small business tax rate to zero. We are now putting money back into the pockets of those who keep our community going. From restaurant owners to tourism operators, this is money returning to hard working Yukoners at a time when it is needed most." Minister of Finance Sandy Silver

The changes to the small business tax rate were introduced in March, 2020 as part of the Budget Measures Implementation Act, 2020.

In 2017, the Government of Yukon changed the Small Business Tax Rate from three per cent to two per cent, saving Yukon small businesses a total of approximately $1 million a year.

The end of one Star sparks the birth of another

The end of one Star sparks the birth of another

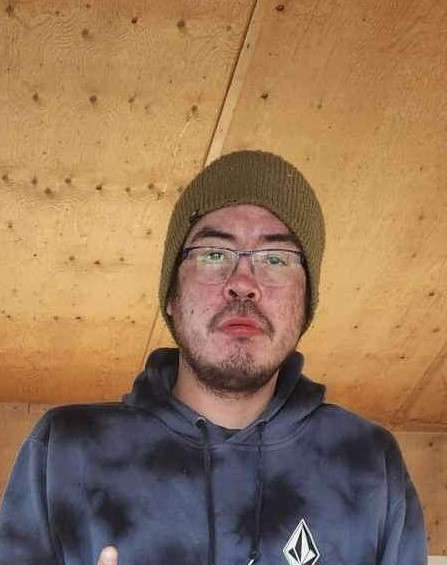

UPDATE: Missing First Nations Haines Junction residents located

UPDATE: Missing First Nations Haines Junction residents located

Minister's home vandalized with threats and profanity

Minister's home vandalized with threats and profanity

Whitehorse Community Thrift Store donates $100K to community organizations.

Whitehorse Community Thrift Store donates $100K to community organizations.

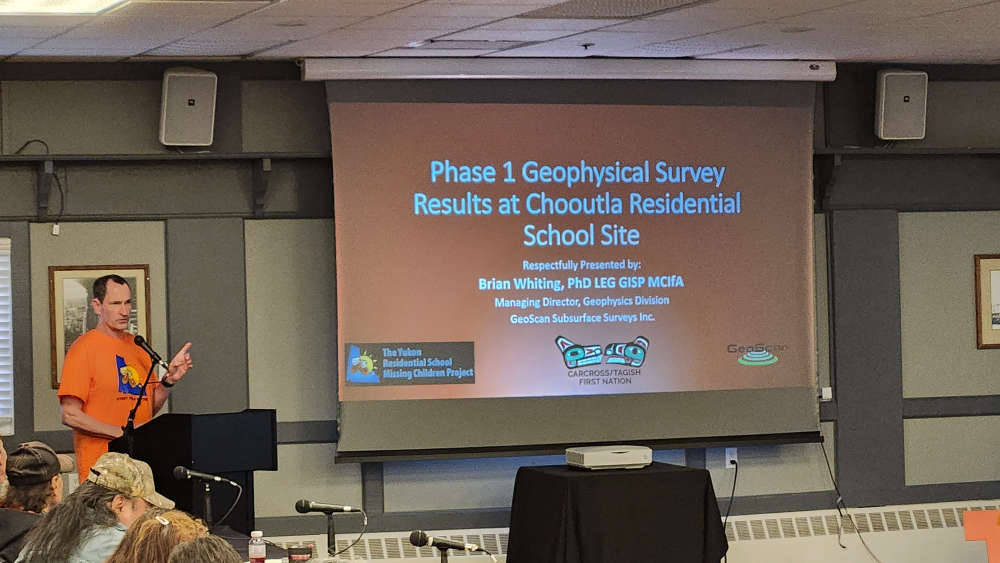

Whitehorse residential school ground searches completed

Whitehorse residential school ground searches completed

Arrested parent accuses department of Education of escalating matters at Holy Family School

Arrested parent accuses department of Education of escalating matters at Holy Family School

Government of Canada announce over $45M to protect Whitehorse Escarpment and Robert Service Way

Government of Canada announce over $45M to protect Whitehorse Escarpment and Robert Service Way

Yukon government passes Health Authority Act

Yukon government passes Health Authority Act

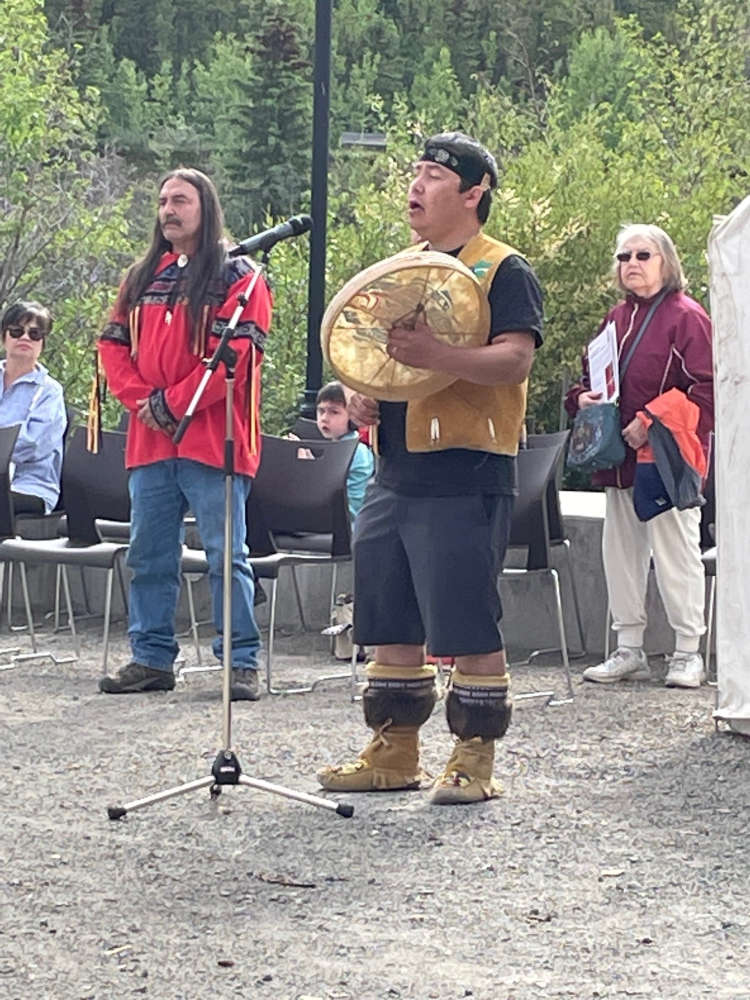

Regalia workshop for special traditional occasions holds in Whitehorse

Regalia workshop for special traditional occasions holds in Whitehorse

Unity in the Community Walk for four Yukon women who died at the Whitehorse Emergency Shelter held in Whitehorse

Unity in the Community Walk for four Yukon women who died at the Whitehorse Emergency Shelter held in Whitehorse

Testimony hearing into the deaths of four Yukon women comes to an end.

Testimony hearing into the deaths of four Yukon women comes to an end.

Ground searches at two former Whitehorse residential school sites begin this week

Ground searches at two former Whitehorse residential school sites begin this week

Coroner's Inquest sees footage of lifeless body ignored for more than 12 hours

Coroner's Inquest sees footage of lifeless body ignored for more than 12 hours

How We Walk with the Land and Water holds two open houses

How We Walk with the Land and Water holds two open houses

Whitehorse Emergency Shelter staff not trained for emergencies, inquest hears

Whitehorse Emergency Shelter staff not trained for emergencies, inquest hears

Premier pledges to meet with Yukoners living in tents to help them find housing

Premier pledges to meet with Yukoners living in tents to help them find housing